Case Study: Provided quant analysis environment using AWS.

We have built a machine learning environment to support data analysis projects in the FX (foreign exchange) service business of a major financial institution, and began providing it around June 2022.

This environment is used as a quantitative analysis environment that makes full use of the latest theories and programming techniques, based on the accumulation of 150 million transaction and price data related to foreign exchange trading in the cloud (AWS), and is currently being utilized for various purposes as a processing platform for big data in addition to quantitative analysis.

Examples of environment utilization:

Quantitative analysis-based algo deal implementation and quantitative operations

Advanced risk management for currency pairs, currency units, and entire portfolios

Provision of information to dealers for profit enhancement

Overview of Services Utilized

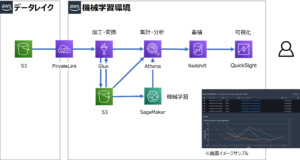

The following AWS services are mainly used for machine learning in this environment.

1. DWH “Amazon Redshift” for storing structured data

2. “Amazon Athena” for data analysis and “Amazon Glue” for data extraction and processing

3. “Amazon SageMaker” as machine learning model creation.

“S3” for data lake and ‘Amazon SageMaker’ for data visualization

“Amazon QuickSight” as a BI (Business Intelligence) tool.